Bank Account Reconciliation Calculator

Bank Account Reconciliation Calculator

This calculator will help you correct any discrepancies between your account register and your account balance. First input the needed information into the “Balances” section, which includes the balance listed on your checking register and the ending balance listed on your bank statement.

Now, under the “Deposits Outstanding” section, enter the necessary information. As you enter the information, any deposits you’ve made that haven’t showed on your account balance will be added automatically.

Next, under the “Withdrawals Outstanding” section, enter any checks or other outstanding charges that have yet to show on your account balance. These amounts will be added automatically as well.

Finally, press RECONCILE, and you’ll be provided with an adjusted ending balance for your checking account. If you’d like, click “Printer Friendly Report,” and a new browser window will open.

Today's Columbus Savings Rates

The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts. Use the filters at the top to set your initial deposit amount and your selected products.

Account Reconciliation Tips & Advice

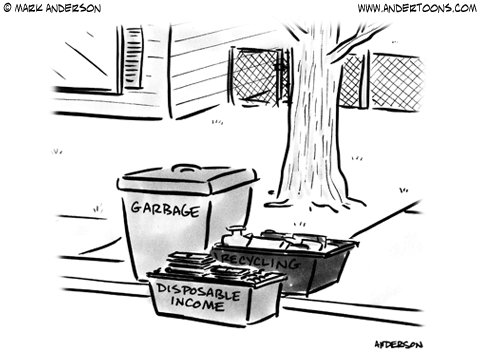

You may have a strong temptation to toss your bank statements in a drawer and never look at them again. But financial responsibility dictates that you not only review your statements but reconcile them with the money in your accounts, especially for a business or organization.

The practice of reconciling your bank account, which simply means matching your transactions to the amount of money in your account, does not have to be a daunting task. Like your personal bank statements, your business bank statements will include records of fees, returned checks, deposits, withdrawals, and ACH debits.

What Are the Benefits of Account Reconciliation?

Here are some reasons why you should keep tabs on your bank account.

- You can help combat identity theft. In the first three months of 2013 alone, the IRS closed more than 200,000 identify theft cases. These statistics show how prevalent the crime of stealing private information for financial gain actually is. When you keep an eye on your bank statements, you can recognize fraudulent charges and alert your bank to launch an investigation.

- You can spot banking or billing errors. Both people and machines can make mistakes in taking payments from your account. Don't assume that automated systems are foolproof, and check your records to be sure bills have been paid correctly.

- You protect yourself from costly overdrafts. Keeping a running tally in your head isn't the best approach to keep your account in the black. You would have to keep up with every cup of coffee, tank of gas, and a million other small purchases that can quickly add up. Instead, keeping a ledger of your balances is a more accurate way of avoiding overdrafts, overdraft fees, and expensive non-sufficient funds fees.

- You make better financial plans. Major purchases like equipment, software, and business travel need a budget. Just like when you're saving for your own personal vacation, you can decide where you need to trim expenses once you have a handle on your spending. You can properly budget for major purchases and know instantly when you have saved enough to afford them.

- Your records are in order for tax and compliance purposes. When you run a business or organization, there are many instances where you will need to present accurate financial data. An audit, a board meeting, or a budget meeting calls for complete financial records. Account reconciliation means that you will always have these records ready for review.

What Steps Do I Need to Take to Reconcile My Account?

You should compare your bank statements to your bank account balance when you receive monthly records from your bank. Online tools, such as the above calculator, can help you enter important amounts to make sure your information matches.

Other account reconciliation tips and advice include:

- Become familiar with your statements. Your account statements should not be foreign to you. Read the statements to see where important information is, such as your beginning balance, ending balance, interest, and transactions. When you can quickly read your statements, the reconciling process goes more quickly.

- Regularly update your own records. Keep your own statements. These records don't have to be anything fancy. It can simply be a notebook that you keep in your desk. It is just one more way to verify that your balances match. Keep a column for pending debits and deposits.

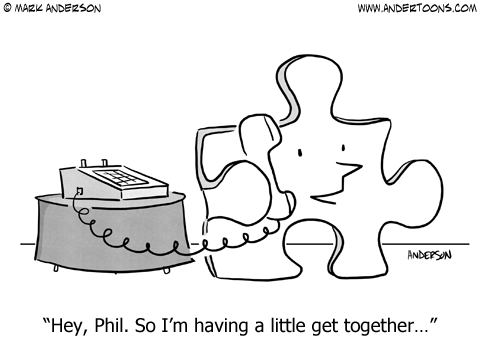

- Have someone else look at the numbers, too. A trusted partner or advisor should also have authority to review the business records and expenses. Another set of eyes can help with spotting errors. It's also helpful to have someone else who is familiar with the accounting system if you aren't available.

- Have the customer service number handy. Sometimes there are transactions on your statement that you're just unclear about. Have a question about pending transactions versus ones that have cleared? Call a customer service representative and ask. It's their job to help you, and once they explain it to you, it will be one less thing on your list of questions. Also, many banks have customer services lines specifically for business clients.

- Check your account online, and sign up for alerts. You don't have to wait for monthly statements. Most financial institutions offer 24-hour access to your transactions online, where you can keep weekly tabs on your balance. You can also sign up for text and/or email alerts to let you know when your account falls under a certain limit or to alert you about large sums of money that have been transferred.

Whether the accounts you are responsible for are personal or for business, learning how to properly keep track of your money offers priceless benefits.

Change privacy settings