Hourly / Yearly Wage Conversion Estimator

Hourly / Yearly Wage Conversion Estimator

Today's Columbus Savings Rates

The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts. Use the filters at the top to set your initial deposit amount and your selected products.

2025 Salary Paycheck Calculator Usage Instructions

Are you looking for more information about a wage offered by a prospective employer? This calculator can convert a stated wage into the following common periodic terms: hourly, weekly, biweekly, semi-monthly, monthly, quarterly, and annually.

First enter the dollar amount of the wage you wish to convert, as well as the period of time that the wage represents. Enter the number of hours you work a week and click on Convert Wage. You’ll see what your wage amounts to when stated as each of the common periodic terms.

We also offer the options to enter the number of work weeks per year (typically around 50 for most, though 48 for some & 52 for others) along with the blended tax rate. If you have your paycheck in hand and do not know what the income tax rate is you can enter zero to convert a paycheck to other pay periods without estimating the impact of income taxes. If you do know your rough bleneded income tax rate & the pre-tax earnings for a period of time then you can quickly calculate pre-tax & post-tax incomes.

The above calculator is designed with quick & easy in mind. If you want a more feature rich calculator with more granular details, read on to check out our detailed paycheck calculator.

Taxes? Overtime? Want More Features?

The above calculator is our quick & easy-to-use simplified calculator which converts wages from one period to another, but it doesn't account for more advanced computations including variables like: overtime wages, retirement contributions, and state and federal taxes including unemployment insurance & FICA contributions. If you would like to use a similar calculator with these additional options, please click here.

Know Your Salary Like the Back of Your Hand

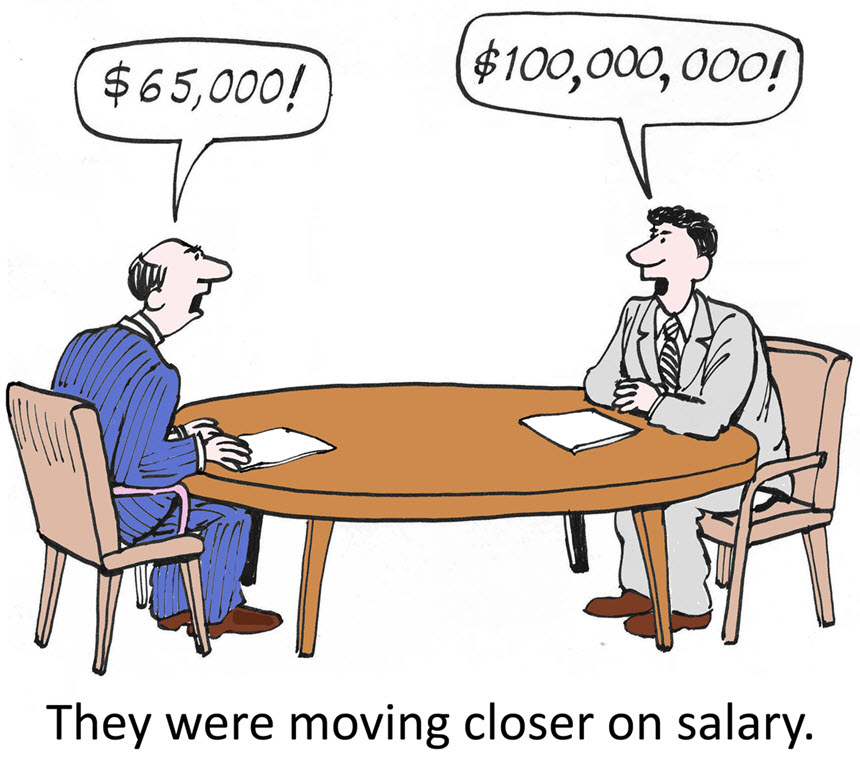

Understanding your salary seems simple. You get a paycheck every couple of weeks and tax forms at the end of the year. However, filling out applications for credit or comparing your salary to others in your field can be tricky, particularly when comparing annual salary to hourly salary or trying to determine commission and benefits. If you are trying to compare how much you currently make versus a new job offer, or if your income changes from month-to-month, determining your hourly, monthly, or annual salary may be more difficult than you think.

A Quick Estimate

For a quick estimate of your annual salary, double your hourly salary and add a thousand to the end. If you make $20 an hour, you make approximately $40,000 a year. If you make $25 an hour, you make about $50,000 a year.

The following table highlights earnings for a person working 40 hours per week at various wages. The table presumes 2 weeks vacation for a total of 50 work weeks per year.

| Hourly | Weekly | Biweekly | Monthly | Annually |

|---|---|---|---|---|

| $7.25 | $290 | $580 | $1,208.33 | $14,500 |

| $10.00 | $400 | $800 | $1,666.67 | $20,000 |

| $15.00 | $600 | $1,200 | $2,500.00 | $30,000 |

| $20.00 | $800 | $1,600 | $3,333.33 | $40,000 |

| $25.00 | $1,000 | $2,000 | $4,166.67 | $50,000 |

| $30.00 | $1,200 | $2,400 | $5,000.00 | $60,000 |

| $35.00 | $1,400 | $2,800 | $5,833.33 | $70,000 |

| $40.00 | $1,600 | $3,200 | $6,666.67 | $80,000 |

| $45.00 | $1,800 | $3,600 | $7,500.00 | $90,000 |

| $50.00 | $2,000 | $4,000 | $8,333.33 | $100,000 |

| $60.00 | $2,400 | $4,800 | $10,000.00 | $120,000 |

| $75.00 | $3,000 | $6,000 | $12,500.00 | $150,000 |

| $100.00 | $4,000 | $8,000 | $16,666.67 | $200,000 |

| $150.00 | $6,000 | $12,000 | $25,000.00 | $300,000 |

| $200.00 | $8,000 | $16,000 | $33,333.33 | $400,000 |

| $250.00 | $10,000.00 | $20,000.00 | $41,666.67 | $500,000 |

| $300.00 | $12,000.00 | $24,000.00 | $50,000.00 | $600,000 |

| $350.00 | $14,000.00 | $28,000.00 | $58,333.33 | $700,000 |

| $400.00 | $16,000.00 | $32,000.00 | $66,666.67 | $800,000 |

| $450.00 | $18,000.00 | $36,000.00 | $75,000.00 | $900,000 |

| $500.00 | $20,000.00 | $40,000.00 | $83,333.33 | $1,000,000 |

If you work 40 hours per week you can also quickly figure out your approximate hourly wage from your annual salary. Divide your annual salary in half and drop the thousand. If you make $60,000 a year, your hourly salary is approximately $30 an hour. $75,000 a year is about $37.50 an hour.

Calculating an Annual Salary from an Hourly Wage

If you make an hourly wage and you'd like a more exact number for your annual salary, you first need to figure out how many hours a week you work. Make sure that you only count the number of hours that you are on the clock; don't count lunch breaks or any other time when you clock out.

If you work 40 hours a week, but clock out for a half an hour lunch a day, you only get paid for 37.5 hours per week. Multiply the number of hours you work per week by your hourly wage. Multiply that number by 52 (the number of weeks in a year). If you make $20 an hour and work 37.5 hours per week, your annual salary is $20 x 37.5 x 52, or $39,000.

Calculating an Hourly Wage from an Annual Salary

If you'd like to figure out your exact hourly wage from your annual salary, you again need to figure out how many hours a week you work. The average, full-time, salaried employee works 40 hours a week. Based on this, the average salaried person works 2,080 (40 x 52) hours a year. To determine your hourly wage, divide your annual salary by 2,080. If you make $75,000 a year, your hourly wage is $75,000/2080, or $36.06. If you work 37.5 hours a week, divide your annual salary by 1,950 (37.5 x 52). At $75,000, you hourly wage is $75,000/1,950, or $38.46.

Calculating Commission

If you get a commission for sales on top of a base salary, this can be more difficult to calculate. Commission tends to differ from month-to-month. The best way to calculate your salary with commission is after the fact. You will have to add up your commission for each month of the year, and add that to your base income to determine your annual salary.

Benefits That Add Up

Another aspect to keep in mind when determining income is the value of your benefits, particularly when deciding whether to accept a new job. The two most common benefits are health insurance and retirement plans. It may be better to accept a lower salary if your employer is willing to cover 100 percent of your health premiums. Determine the amount that you will have to pay for your premiums and subtract that from your annual salary to figure how much you'll actually be bringing home.

Retirement plans are another way to increase your income. If a company is willing to match your annual contribution, add that amount to your salary, since you are gaining that amount of money in addition to your salary.

If your company is paying for additional things such as cell phone use, a company car, or a computer, figure out the value of those items and add that amount to your salary, as well, since those are costs that you are no longer paying. You may find out that you are making more money than you originally thought.

Although credit applications are only concerned with provable income, there are many perks which can increase your salary significantly. Whether you are working for commission or receiving benefits, or not, knowing your hourly and annual salary is always wise and can come in handy in many situations, from buying a car to comparing job offers to determining if your job is paying you what you are worth.

The Ideal Time to Ask for a Raise or Find a New Job

If economic conditions or work conditions at your employer sharply deteriorate, it may already be too late to look for another job, as increased stress and uncertainty will likely make applicants look less appealing to other employers. And it is hard to find a new job when the broader economy is in a downturn.

The best time to look for another job is when things are still going well at your current job.

Over the past couple decades outsourcing, technology, and a series of economic crises have drastically lowered the labor participation rate in the United States.

The lowering labor participation rates is due in large part to globalization. When it was coupled with low interest rates in the wake of the Great Recession, corporate profits jumped to record highs.

Labor has been receiving a lower share of productivity gains across the economy. If the rate of return on capital is greater than the rate of growth across the economy it leads to an increasing concentration of wealth.

This was the central thesis of Thomas Piketty's Captial in the Twenty-First Century book. Such concentration of wealth and power leads to social & economic instability.

Below is our advanced paycheck convertor. If you would like to use the basic one instead, please click here.

Advanced Conversion Calculator